What does the National Insurance increase mean for nanny employers?

In the Autumn Budget, it was announced that come April 2025, Employer’s National Insurance contributions will be increasing from 13.8% to 15%. It was also announced that on the 6th April 2025, the Secondary Threshold will be reduced from £9,100 to £5,000 per year, this means that the threshold at which employers are liable to pay National Insurance is lower. But what does the National Insurance increase mean for nanny employers?

The increase to national insurance contributions will mean that the total cost of employing a nanny will increase. Below, we have shared 3 examples of how this increase will impact 3 typical nanny scenarios:

Please note, these calculations are based on gross salaries and the figures are rounded up. These calculations are for guidance only and should not be used to pay your employee.

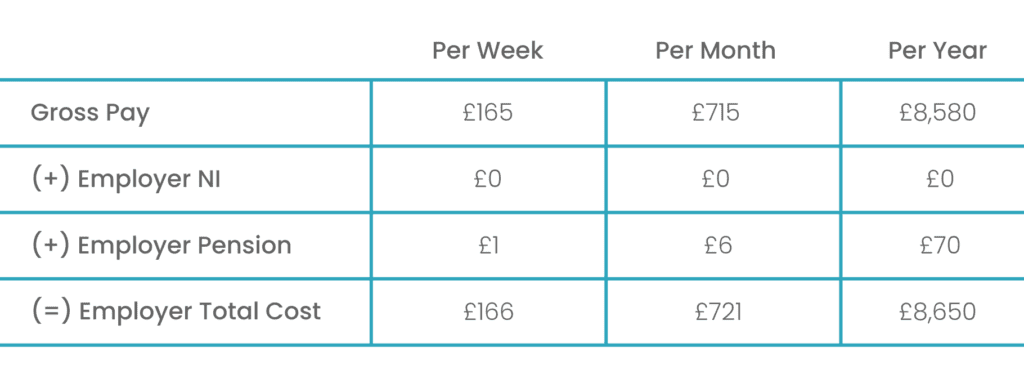

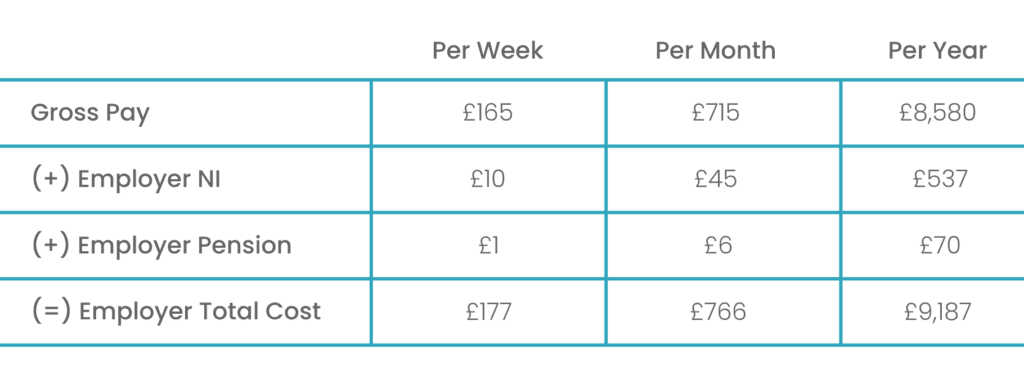

Example 1

“I employ a nanny who works 10 hours a week and earns £16.50 per hour”

Tax Year 2024-2025

Tax Year 2025-2026

What does this mean?

The total cost to the employer has increased by:

- £10 per week

- £45 per month

- £537 per year

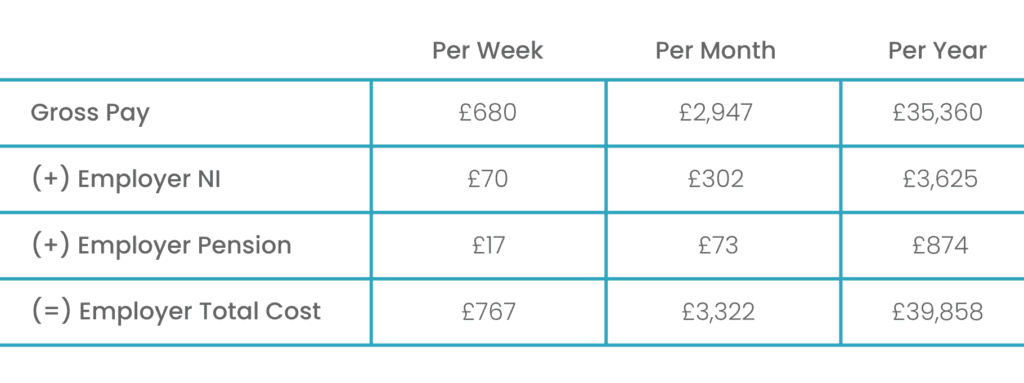

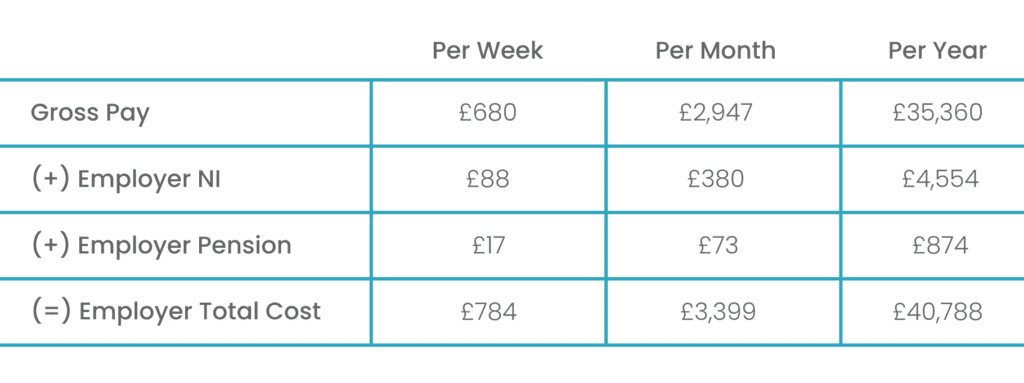

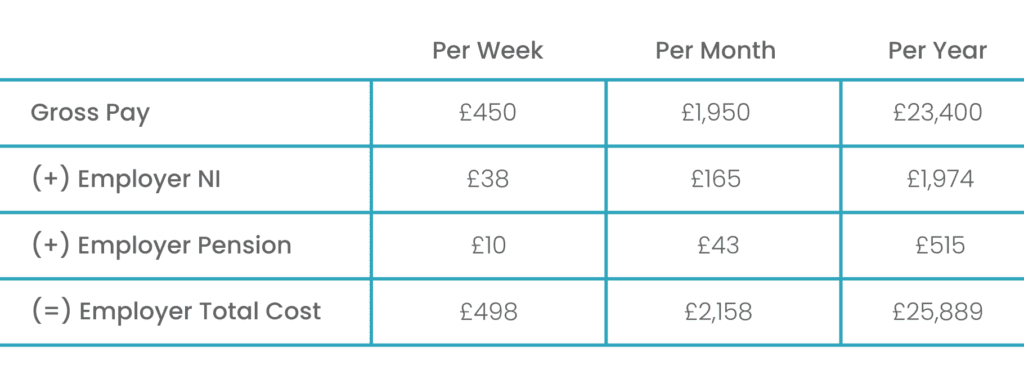

Example 2

“I employ a nanny who works 40 hours a week and earns £17 per hour”

Tax Year 2024-2025

Tax Year 2025-2026

What does this mean?

The total cost to the employer has increased by:

- £18 per week

- £78 per month

- £929 per year

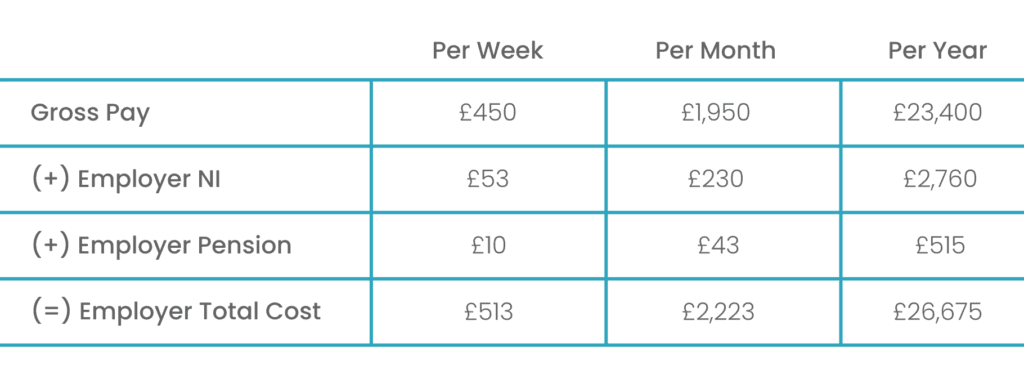

Example 3

“I employ a nanny who works 25 hours a week and earns £18 per hour”

Tax Year 2024-2025

Tax Year 2025-2026

What does this mean?

The total cost to the employer has increased by:

- £15 per week

- £66 per month

- £786 per year

What is my total cost as a nanny employer?

We have updated our Salary Calculator to reflect the Tax Year changes so that you can check what your costs will be based on the new National Insurance rates.

How can Nannytax help?

Nannytax customers, please know that our teams are here to support you with this change and you can contact us with any queries or concerns you may have.

At Nannytax, our friendly team of nanny payroll experts have seen every scenario and no problem is too big. We’ll take care of everything, from setting up the right contract to handling your nanny’s payslips and dealing with HMRC. We can also provide you with Employers Liability Insurance and manage your nanny’s pension scheme.